49+ can you write off interest paid on your mortgage

Web Most homeowners can deduct all of their mortgage interest. Compare offers from our partners side by side and find the perfect lender for you.

Kaiserslautern American March 15 2019 By Advantipro Gmbh Issuu

Web For 2021 tax returns the government has raised the standard deduction to.

. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Web Youre entitled to deduct only the mortgage interest that you personally paid regardless of who received the Form 1098 from the lender. You must also have a.

The terms of the loan are the same as for other 20-year loans offered in your area. The write-off is limited to interest on up to 750000 375000 for married-filing. You can write off the interest you pay on up to 1000000 of mortgage debt on your home or second home as long as you took out the mortgage.

The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately. Married filing jointly or qualifying widow. Web As of the beginning of 2018 couples who file their taxes jointly are only able to deduct interest on up to 750000 of eligible mortgages which is down from 1 million.

However if your property operates as a. Web 49 Hallmark Hill Dr Wallingford CT 06492. However you can only deduct the interest that you paid during that year.

If you took out. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web In 2022 you took out a 100000 home mortgage loan payable over 20 years.

Web You can only deduct a total of 10000 5000 for those married filing separately for property taxes plus state and local income taxes or sales tax instead of. LawDepot Has You Covered with a Wide Variety of Legal Documents. Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098.

Web With itemizing your taxes you may deduct any donations to a 501c non-profit organization deduct business expenses and write off mortgage insurance. 49 Hallmark Hill Dr 49G Wallingford CT 06492. Single or married filing separately 12550.

Web You can claim the deduction every year that you make payments on your loan. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Create Your Satisfaction of Mortgage.

Ad Developed by Lawyers. -- bd -- ba -- sqft. Ad Thinking About Paying Off Your Mortgage that may not be in your best financial interest.

Web The interest you pay for your mortgage can be deducted from your taxes. Web If your total property is rented out for the entire year you can deduct 100 of the mortgage interest paid on that property. Ad How Much Interest Can You Save by Increasing Your Mortgage Payment.

Expert says paying off your mortgage might not be in your best financial interest. Ad Our Trusted Reviews Help You Make A More Informed Refi Decision. Web Important rules and exceptions.

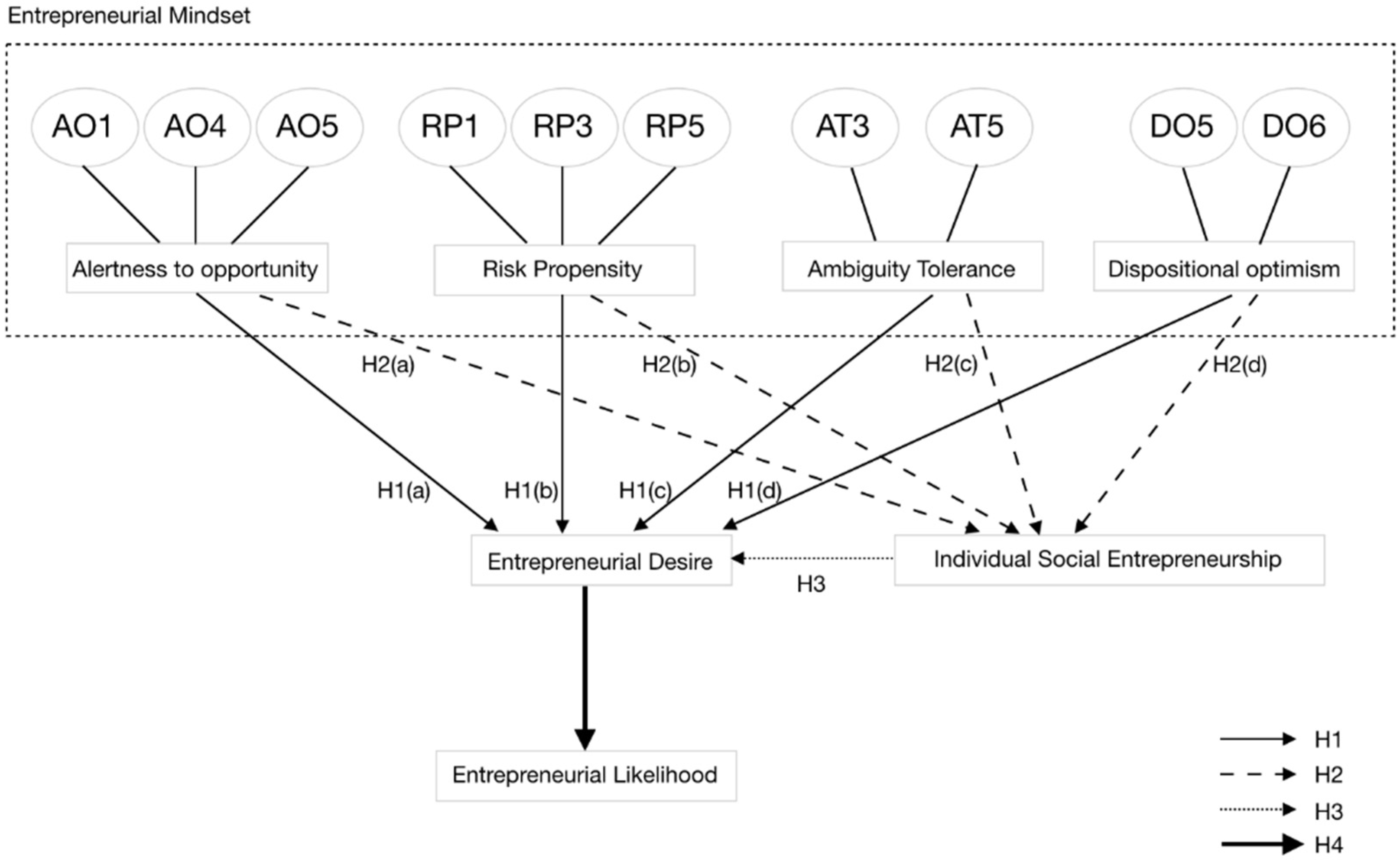

Sustainability Free Full Text The Nexus Of Social Cause Interest And Entrepreneurial Mindset Driving Socioeconomic Sustainability

What Your Mortgage Interest Rate Really Means Money Under 30

Nektar Impact Lx 49 Usb Midi Controller Bothners Musical Instrument Stores

Ekaterinburg And Sverdlovsk Region Marchmont Capital Partners

89 Insurance Statistics You Should Know Industry

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

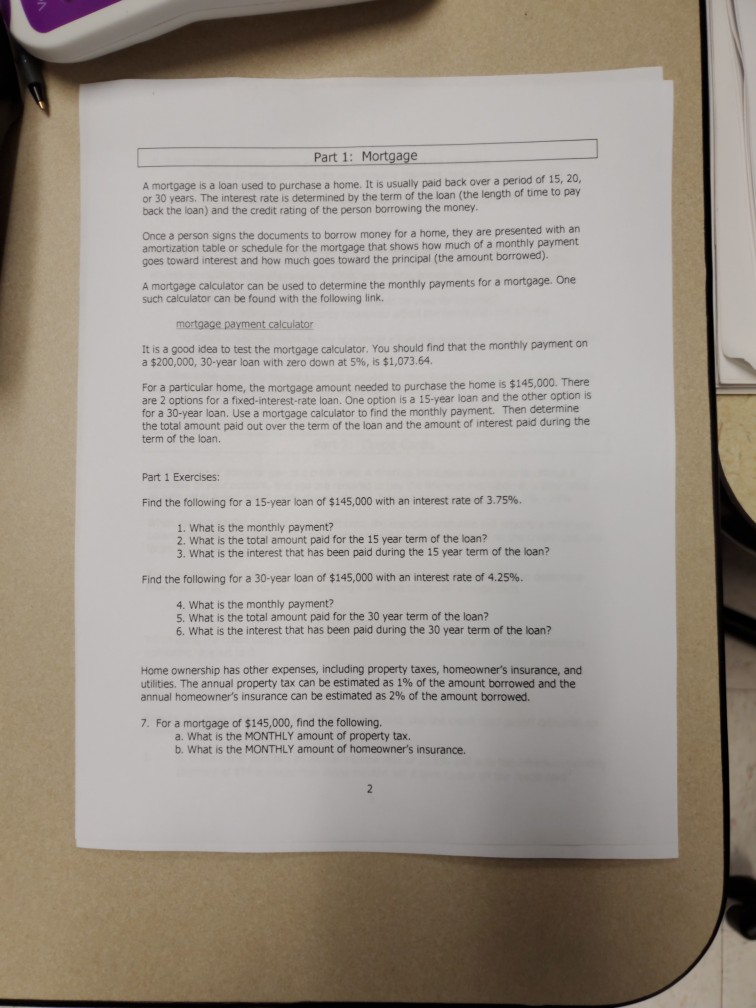

Solved Part 1 Mortgage A Mortgage Is A Loan Used To Chegg Com

Semi Furnished Property For Rent In Miyapur Hyderabad 49 Rent Semi Furnished Property In Miyapur Hyderabad

Explaining The Bundesliga S 50 1 Rule World Football Faq Bundesliga

Free 49 Insurance Proposal Forms In Pdf Ms Word Excel

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Mortgage Interest Deduction A 2022 Guide Credible

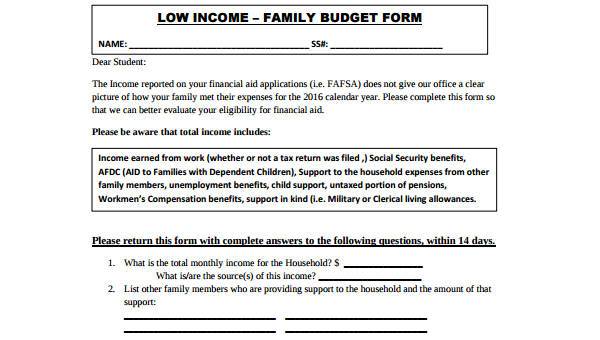

Free 49 Budget Forms In Pdf Ms Word Excel

House For Sale In Kasargod 49 House In Kasargod

Philangles Sale 370 By Philangles Ltd Issuu

Calculating The Home Mortgage Interest Deduction Hmid

Is Mortgage Interest Deductible In 2023 Consumeraffairs