12+ 72T Calculator

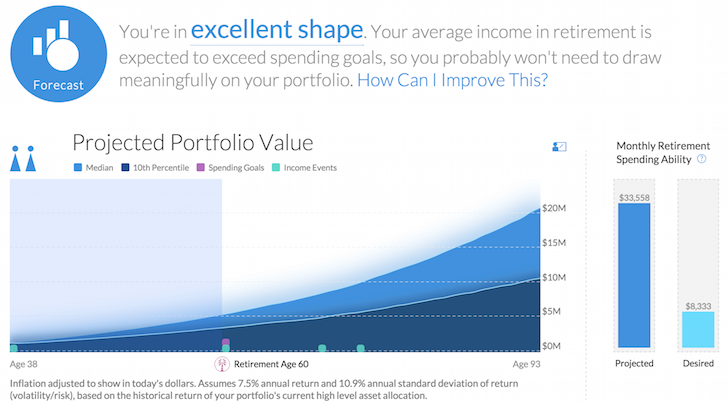

Let this calculator help you determine what your allowable 72T Distribution might be and how it could even fund your early retirement. 72 t Calculator.

Tsp Sepp A Guy On The Internet Unlocks The Secret To Pay Zero Penalties Government Worker Fi

72 t early distribution analysis.

. You can use one or more of these to verify your results from. Internal Revenue Code section 72 t allows for penalty free early withdrawals from retirement accounts under certain circumstances and rules. Internal Revene Code sections 72 t and 72 q provide for tax-penalty-free early withdrawals from retirement accounts under certain.

The Internal Revenue Code section 72 t and 72 q can allow for penalty free early withdrawals from retirement accounts under certain circumstances. 72 t Calculator The Internal Revenue Code section 72 t and 72 q can allow for penalty free early withdrawals from retirement accounts under certain circumstances. The IRS rules regarding 72 t q distributions.

The Internal Revenue Code section 72 t and 72 q can allow for penalty free early withdrawals from retirement accounts under certain circumstances. If you are having difficulty using this Web site please call Putnam Investments at 1-888-4-Putnam. Penalty-Free 72 t SEPP income planning.

The IRS Rule 72T allows for penalty free early withdrawals from retirement accounts. It is a useful rule of thumb for estimating the doubling of an investment. Use this calculator to determine your allowable 72T Distribution and how it can help fund your early.

Use this calculator to determine your allowable 72 t q distribution and how it may be able to help fund your early retirement. Minimum Balance Calculator The Minimum Balance calculator is exclusive to 72tNET and helps you calculate the initial balance you should have in your SEPP retirement account s so you. You can use the rule the other way around too if you want to double your money in twelve years just divide 72 by 12 to find that it will need an interest rate of about 6 percent.

We have methods to distribute from retirement accounts before age 59 12 for multiple purposes including full retirement the starting of a. 72 t Substantially Equal Periodic Payments Calculator. C72t Calculator - powered by SSC 72 t Calculator Taking early withdrawals from retirement accounts To help fund an early retirement or to tap into retirement savings prior to age 59½.

There are several online calculators that will calculate your annual SEPP distribution amount for you using the 3 allowed methods. The Rule of 72 is a simplified version of the more involved compound interest calculation. Information and interactive calculators are made.

The 72 t Early Distribution Illustration helps you explore your options for taking IRA distributions before you reach 59½ without incurring the IRS 10 early. For more information call the IRA Hotline at 1-888-661-7684. This calculator provides both.

If you need income from your IRA prior to age 59 ½ and want to avoid the 10 early distribution penalty our calculator can be used.

Mil Hdbk 781a Pdf Pdf Reliability Engineering Confidence Interval

Rule Of 55 Vs 72 T Retirement Plan Withdrawals Smartasset

72 T Series Of Substantially Equal Periodic Payments Update The Fi Tax Guy

8pcs Flex Head Chrome Plated Crv 72t Ratcheting Wrench Set

Articles

Chris Vermeulen Articles And Videos On Fxmag Com

Pdf Pdfwbpmscmindfulnessstudiesviviennerobertsonstudentid51338916 2

Use Rule 72 T To Withdraw Money Penalty Free For Retirement

Understanding Irs 72t Wiser Wealth Management

Revell 1 72 T 80 Bv 03106

72 T Withdrawals Calculator Strata Trust Company

How Much Does Nbyula Pay In 2023 29 Salaries Glassdoor

What Is An Early Ira 72t Distribution 72t Distribution 401k Rollover Irs 72 T Specialists

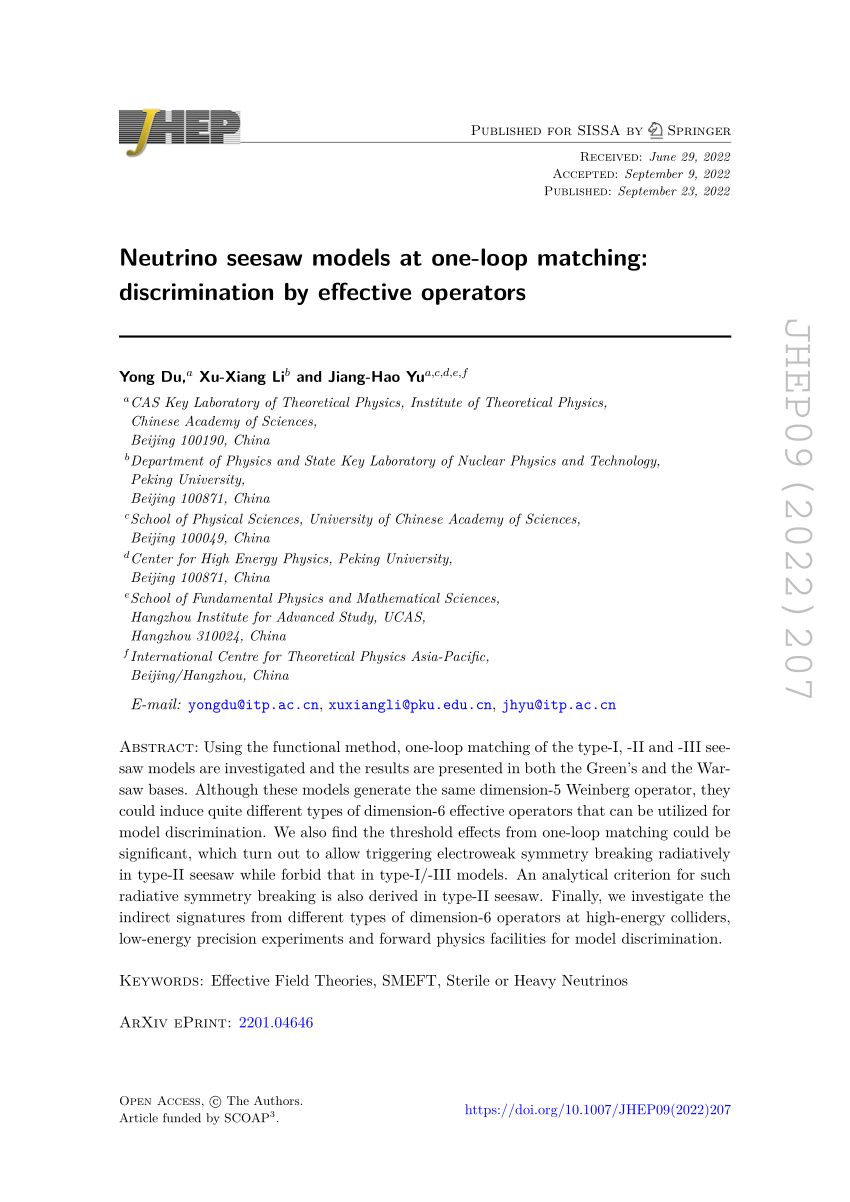

Pdf Neutrino Seesaw Models At One Loop Matching Discrimination By Effective Operators

Gearwrench Metric Standard And Stubby Ratcheting Wrench Set 72t With Eva Foam Tray 28pc Walmart Com

Should You Use Irs Rule 72 T To Access Your Retirement Fund

Rule 72 T No Penalties On Retirement Withdrawals Before Age 59 1 2 Youtube